|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

biwvuw5n0j CRM Software for Credit Unions: Enhancing Member Engagement and Operational EfficiencyCredit unions face unique challenges in managing member relationships and optimizing operational processes. Implementing CRM software can significantly aid in overcoming these challenges by improving member engagement and streamlining operations. Understanding CRM SoftwareCustomer Relationship Management (CRM) software helps organizations manage their interactions with current and potential customers. For credit unions, this means better service for members and efficient handling of inquiries and transactions. Key Features of CRM for Credit Unions

Benefits of Implementing CRM

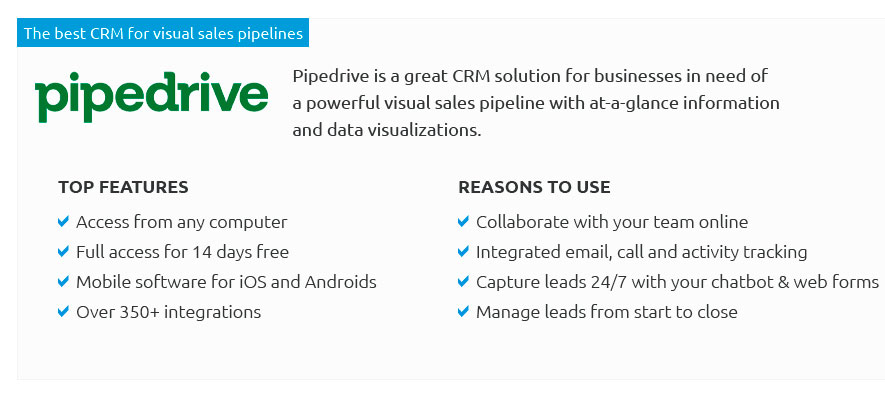

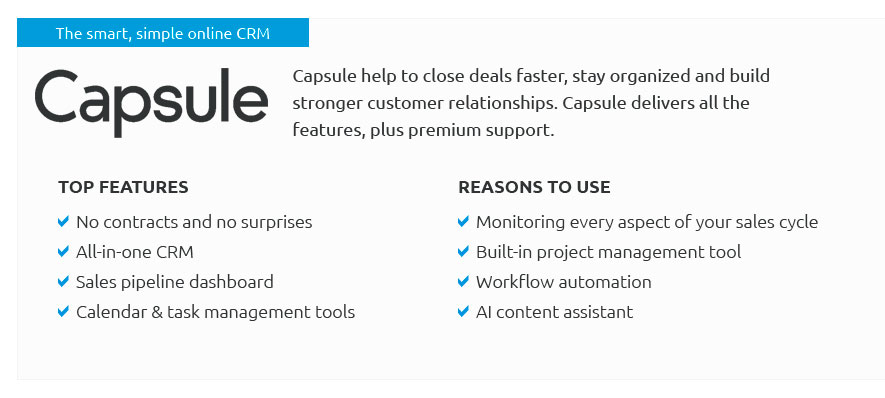

Choosing the Right CRM SoftwareSelecting the right manage customer solution involves evaluating several factors such as ease of integration, scalability, and specific features that meet the needs of credit unions. Factors to Consider

Partnering with CRM Software ProvidersWorking with expert crm software development services can provide a customized approach to meet the unique needs of credit unions. Frequently Asked Questions

https://www.sugarcrm.com/industries/financial-services/credit-unions/

A CRM software tailored specifically for the financial services industry can greatly benefit a credit union by efficiently streamlining processes, enabling ... https://www.creatio.com/industries/credit-unions

One platform to automate credit union workflows and CRM with no-code. Get a demo. End-to-end member-centric automation for Credit Unions. https://www.findmycrm.com/industries/crm-for-credit-unions

A CRM system for credit organizations simplifies business processes by controlling loan disbursement and repayment, as well as managing debtors.

|